Don't miss out on100% tax relief

Track your time abroad. Claim what you're owed.

Try our free eligibility checker to see if you qualify (1 min / 6 steps)

How it works

Stay on top of your seafarers tax in 3 simple steps

1. Log your time abroad

Enter departure/return dates into your own personal calendar. We'll keep track of all your time abroad in one place, accessible from anywhere online.

2. Track your eligibility

Get live status updates. Our app automatically checks the 365‑day rule & half‑day rule so you don't have to.

3. Save your claim

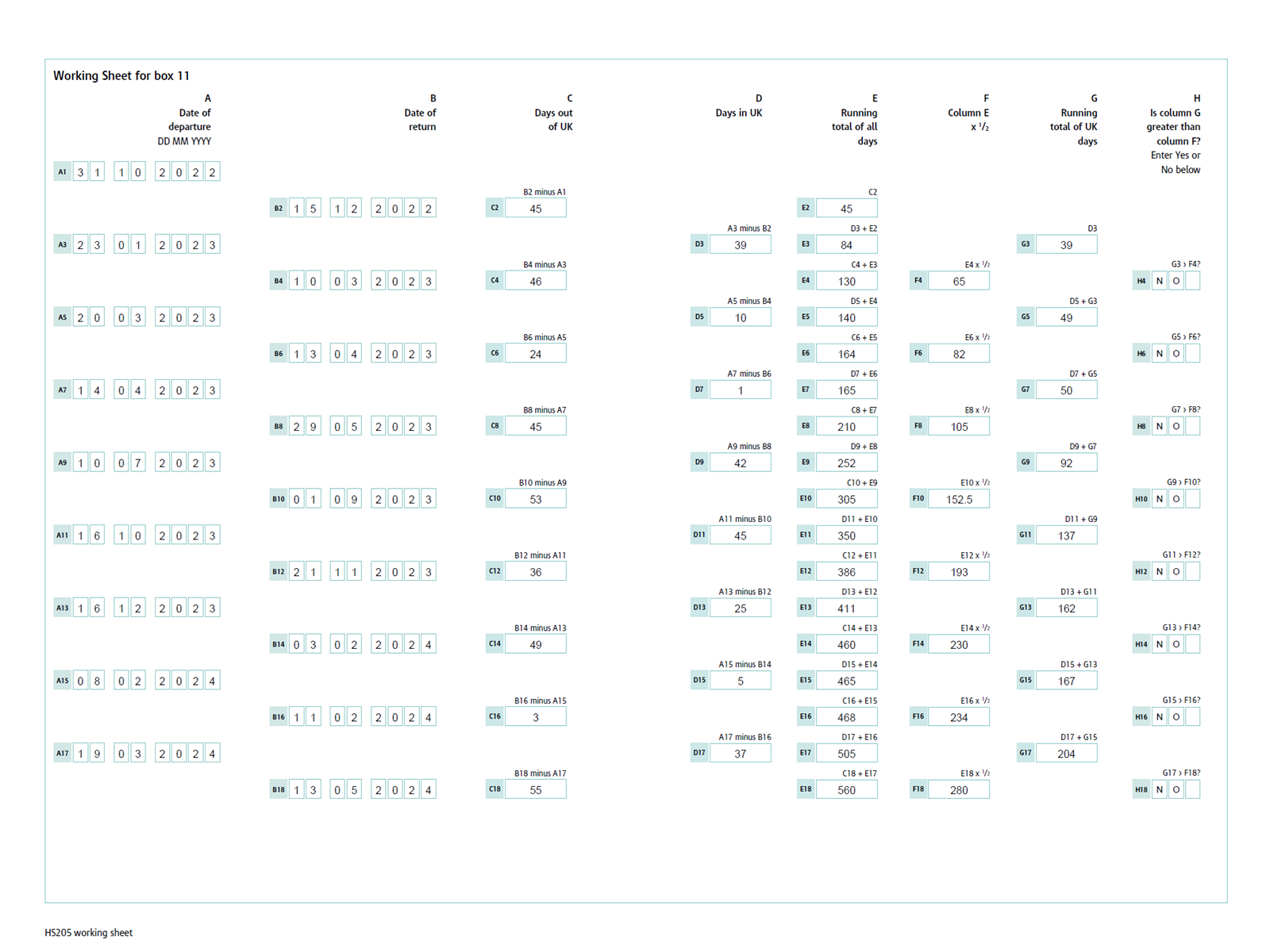

Sign up for free to secure your data and generate HMRC forms (HS205 working sheet). Know where you stand, and share with your accountant.

Why choose Seadays

The easiest way to track your days abroad and build your claim.

Up to date

Designed in line with latest HMRC guidance.

Saves time

No spreadsheets, no paperwork – just simple tracking.

Free to start

Accountant‑ready reports with no upfront costs.

23.7K

UK seafarers active at sea in 2024

≈15K

Seafarers benefiting from SED (1999 estimate)

100%

Relief on qualifying seafaring earnings

What you get

Everything you need to build and defend your claim

Seadays gives you a private, seafarer-first workspace that keeps your voyages compliant, your records organised, and your tax relief on track.

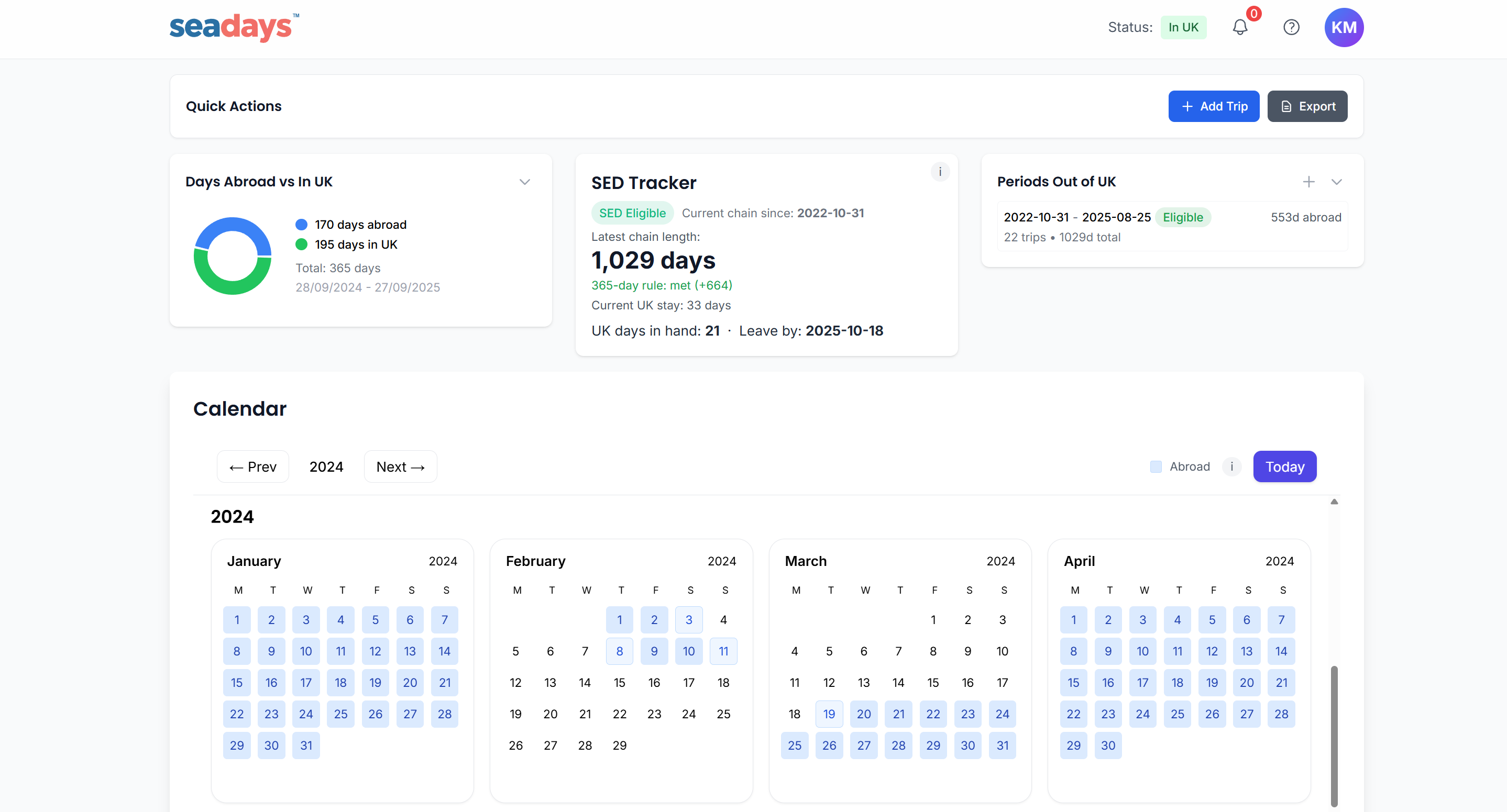

Private dashboard

View every trip, claim milestone, and supporting document from a secure workspace that is yours alone.

Calendar at a glance

Plot departures and returns on an interactive calendar so you always know how many days you have outside the UK.

Abroad trip tracking

Log your trips abroad and upload evidence documents in seconds to keep things updated without the hassle of spreadsheets.

SED status updates

Monitor the 365-day and half-day rules automatically with colour-coded progress and alerts when you qualify.

Smart reminders

Get notified on a regular basis so you never lose track of your claim.

Be HMRC ready

Produce HMRC HS205 working sheets and store your evidence for each trip. Ready to share with your accountant and HMRC if needed.

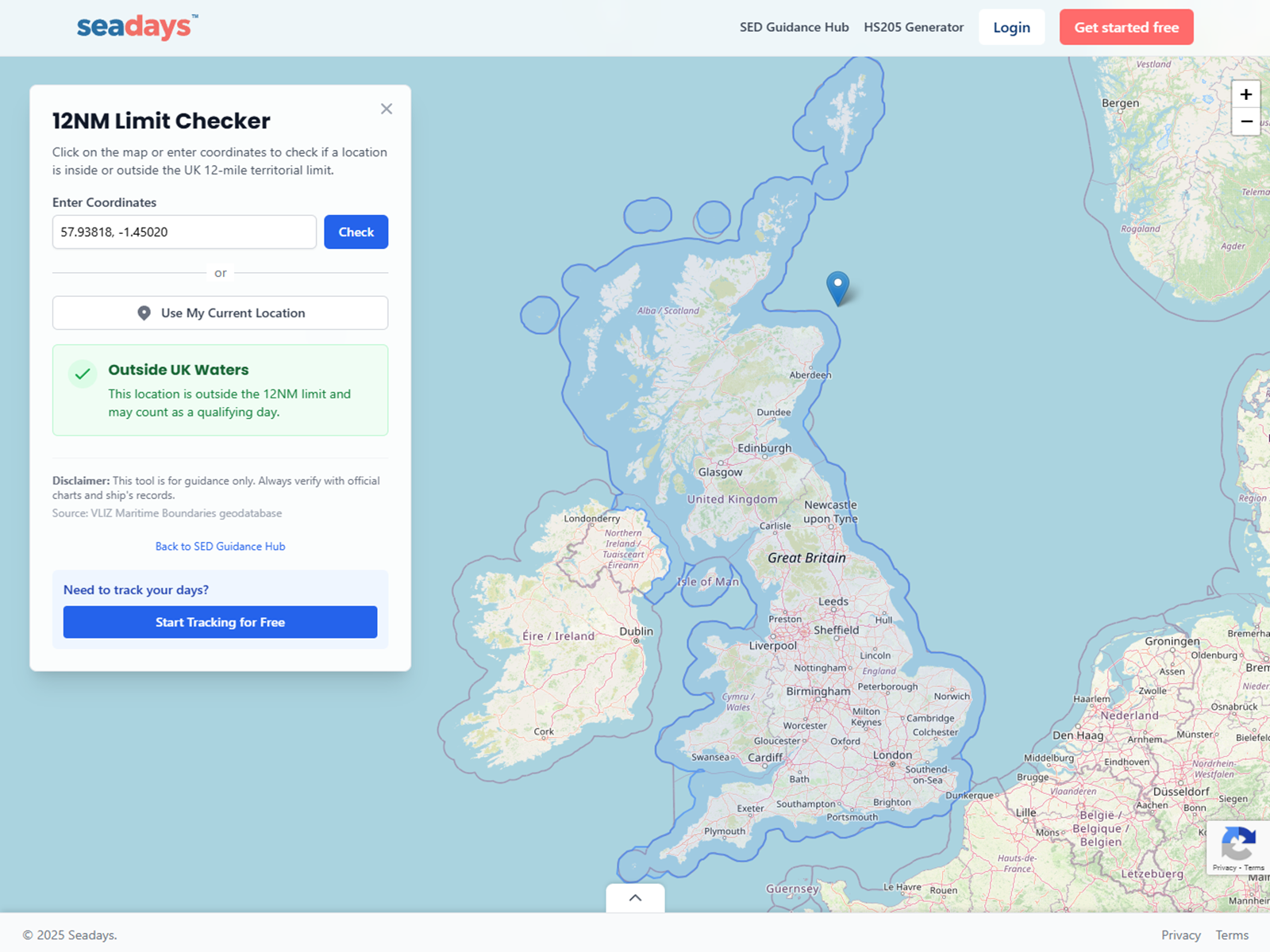

Inside or outside the 12NM limit?

Unsure if your current position counts as a day abroad? Use our interactive 12NM limit checker to verify your coordinates against UK territorial waters instantly.

Generate your HS205 form instantly

Don't struggle with manual calculations. Enter your dates and let our free tool generate a compliant HMRC HS205 working sheet for you to download and keep.

Need step-by-step SED guidance?

Explore our in-depth HS205 explainer with examples, day-counting tips, and compliance checklists tailored for seafarers. It’s updated with the latest HMRC rules.